Ism Index Meaning

Contents:

Oil https://forexarena.net/s are on the move this morning, with oil prices dipping by 2.0% in early trading after the Financial Times reported that Saudi Arabia has indicated to western allies it could raise… A significant deviation of a real value from a forecast one may cause a short-term strengthening or weakening of a national currency in the Forex market. The threshold values of the indicators signaling the approach of the critical state of the national economy occupy a special place. On the one hand, the return of US dollar strength has led to a retracement of previous gains in the region, but at the same time we have seen another rise in market rates that could help FX in CEE to gain again.

- Department of Commerce to measure various activities within supply management.

- The weights were originally determined by Theodore Torda of the US Department of Commerce to improve the accuracy of the survey data in anticipating changes in GDP.

- These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘ism.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors.

However, the relationship between PMI and GDP varies based on the country’s stage of economic development. These example sentences are selected automatically from various online news sources to reflect current usage of the word ‘ism.’ Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. TTH’s integrated approach to design, prototyping, and production allows you to bring your concept to market faster, more cost-effectively, than virtually anyone else. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. The ISM survey is widely diversified across sectors, based on the North American Industry Classification System , weighted by the share of U.S.

United States ISM Purchasing Managers Index (PMI)February 2023 Data

However, the definition of ‘Manufacturing PMI’ may describe the survey generically as well as specifically the headline indicator from the survey. The latter is a weighted average of diffusion indices from five survey questions. The weights were originally determined by Theodore Torda of the US Department of Commerce to improve the accuracy of the survey data in anticipating changes in GDP. The Non Manufacturing ISM Index can trend in one direction or another for many months, and this can provide valuable long term information on the state of the service sector. One of the major benefits in evaluating the ISM report is that the data provides valuable insight on a national basis rather than on a regional level.

The operations include new orders, manufacturing, employment, manufacturer deliveries, inventories, inventories of consumers, product prices, order backlog, new export orders, and imports. Investors can better understand the national economic patterns and conditions by tracking the ISM Manufacturing Index. In response to higher corporate earnings, investors expect a bullish stock market as the index goes up.

After leaving the field of intelligence he went to work at a global macro hedge fund. He’s been professionally involved in markets since 2005, has consulted with a number of the leading names in the hedge fund space, and now manages his own family office while running Macro Ops. He’s published over 300 white papers on complex financial and macroeconomic topics, writes regularly about investment/market trends, and frequently speaks at conferences on trading and investing.

Amendments to the ISM Code

This report details month-over-month changes in growth or contraction in addition to reporting how long each index has been moving in its current direction. The ISM Manufacturing Index is useful in understanding the direction of economic activity from the lens of the country’s primary manufacturing companies. For each of the categories, a diffusion index is calculated by adding the percentage of respondents reporting an increase to half of the percentage of respondents reporting no change.

- A composite PMI™ is the weighted average of manufacturing and service sector PMIs for a given geography or economy, produced by S&P Global.

- A rising level of the ISM manufacturing Index means a healthy manufacturing sector that could bode well for corporate earnings and the stock market.

- It is one of the earliest economic activity measures that investors and business people get regularly.

- Even if two models have, on average, equal predictive capacity, in any finite sample of data one model will likely outperform the other.

- Wherein the term is the realized value of the annualized average inflation rate for indicator j over the period from t to t+h, and is the forecasted value of that inflation rate.

On the other hand, the models with the ISMPI forecast PCE inflation and core PCE inflation more poorly than the models without. The values along the horizontal axis indicate the relative timing of the ISMPI to the inflation indicators, with negative numbers indicating a lead of the ISMPI value relative to the inflation indicator. We produce indicators and datasets to inform the public, policymakers, and researchers about economic conditions, including inflation, employment, and risks to the financial system. I’m sure you’ve heard all the talk in financial media about various “economic indicators”. The so-called experts use these magic numbers to figure out the state of the economy.

Is ISM A Leading Indicator?

When business is good, purchasing managers have to buy more raw materials to fulfill orders. When business is bad, purchasing managers have to buy fewer raw materials to fulfill orders. And at the same time that the ISM PMI economic report was released, we had another important fundamental event occurring. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

A return to sub-50 levels is seen as rather unlikely and would cause a significant unwinding of hawkish Fed bets and probably the start of a new dollar downtrend. A read in the area would probably be enough to generate some dovish repricing and should weigh on the dollar. However, as long as jobs data remain strong , we shouldn’t see a dollar downtrend fully materialise. When the ISM Manufacturing PMI number is below 50, it indicates the manufacturing sector is contracting, which means the economy is contracting and stocks will most likely decrease in value. When the ISM Manufacturing PMI number is above 50, it indicates the manufacturing sector is expanding, which means the economy is growing and stocks will most likely increase in value.

These indexes therefore vary between 0 and 100 with levels of 50.0 signaling no change on the previous month. Readings above 50.0 signal an improvement or increase on the previous month. Readings below 50.0 signal a deterioration or decrease on the previous month. The greater the divergence from 50.0 the greater the rate of change signaled. The PMI can point to whether economic conditions are better or worse at the companies surveyed. The formula used to calculate the PMI assigns weights to each common element and then multiplies them by 1 for improvement, 0.5 for no change, and 0 for deterioration.

The institute also publishes a Semi-Annual Economic Forecast in May and December of each year. The Purchasing Managers Index is a diffusion index summarizing economic activity in the manufacturing sector in the US. The index is based on a survey of manufacturing supply executives conducted by the Institute of Supply Management.

This is a change of -1.46% from last month and -19.15% from one year ago. Conversely, if there are more workers looking for work than open positions, it can indicate that economic growth is slowing and unemployment may increase. The ISM Services PMI (formerly the Non-Manufacturing NMI) is compiled and issued by the Institute of Supply Management and contains a diffusion index based on survey data. Similar purchasing managers indices are published by the Ifo Institute for Economic Research in Germany, the Bank of Japan in Japan , the Caixin China PMI published by Markit and the Swedish PMI run by private bank Swedbank. For each main survey question, respondents are asked to provide a reason for any change on the previous month, if known.

Employment Trends

The groups also divide the survey into the manufacturing and services sectors, since manufacturing is export-dependent, and services are more sensitive to the domestic economy. Last week, theInstitute for Supply Managementpublished its monthly ISM Manufacturing Report for April. It has been well documented in other news articles that this figure is the lowest PMI since May 2013. ISM Manufacturing Index, formerly known as Purchasing Managers Index , calculates manufacturing activity based survey conducted every month by Institute for Supply Management of purchasing managers from more than 300 manufacturing companies.

A key feature of the PMI surveys is that they ask only for factual information. They are not surveys of opinions, intentions or expectations and the data therefore represent the closest one can get to “hard data” without asking for actual figures from companies. The ISM Services index regained its footing, reaching above the expansionary threshold after an unexpected dip in December. The new orders subcomponent saw a sizeable gain, which recovered all of December’s losses and more.

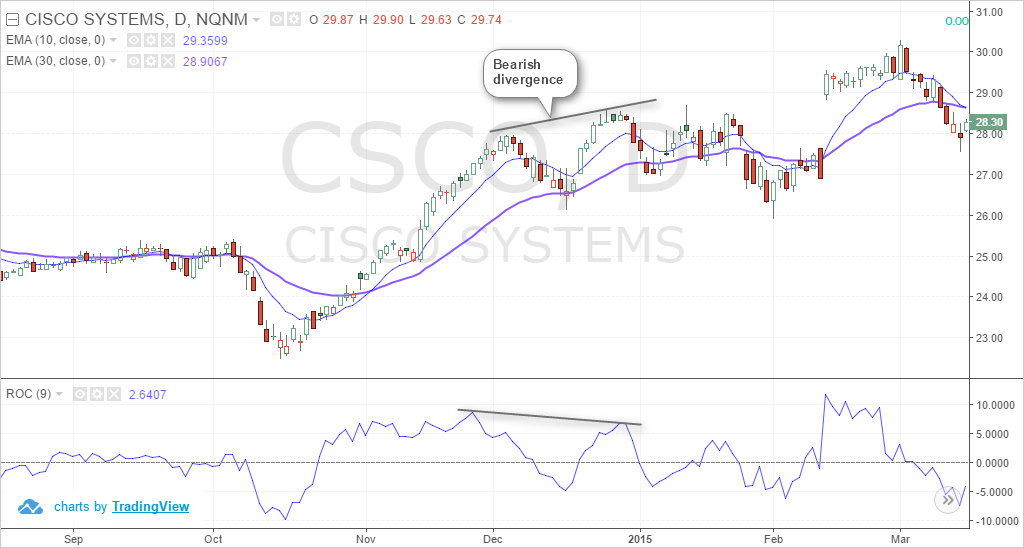

One reason for this is that the non-manufacturing sector is generally much less volatile and more foreseeable than its US Manufacturing Index counterpart. Our live trading webinarscover various topics related to the forex market like PMI data, currency news, and technical chart patterns. Sign up for our monthly newsletter to get the latest research, expert interviews, and upcoming events from the Cleveland Fed.

Rate Expectations: Stocks Struggle for Direction as Yields, Dollar Push Higher – Macy’s (NYSE:M), Salesfo – Benzinga

Rate Expectations: Stocks Struggle for Direction as Yields, Dollar Push Higher – Macy’s (NYSE:M), Salesfo.

Posted: Thu, 02 Mar 2023 19:45:32 GMT [source]

Also, some service sectors may experience growth while others contract, which can be helpful when choosing which industry to invest in via equities or corporate bonds. The ISM Services PMI provides significant information about factors affecting total output, growth, and inflation. The services report measures business activity for the overall economy; above 50 indicating growth, while below 50 indicating contraction. Conversely, the Manufacturing PMI report surveys manufacturers to determine the level of output and economic activity in production facilities as well as the commodity purchases and inventory that are used to produce those goods.

For example, the Manufacturing PMI data for the month was recorded to be 58.7, and that was an increase from 57.3 from the previous month. At the same time, the percent point increase in the Manufacturing Index (+1.4) is lagging behind the Percent point change for the Non Manufacturing sector (+1.8). Keep an eye on DailyFX market news for the latest updates on currency prices, or bookmark our economic calendar to prepare for upcoming events. Building on the results in the previous section, we assess the predictive content of the ISMPI in the context of forecasting models.

Though the https://trading-market.org/ PMI has been around for much longer, there was a need to measure the economic situation within the service sector as well. This is especially true since the service sector is attributed a majority percentage of US GDP in real terms As such the ISM Non-Manufacturing report was born. Note that in any exercise such as this one, there is a question of how confident one can be that the results are not, in some sense, the result of randomness. Even if two models have, on average, equal predictive capacity, in any finite sample of data one model will likely outperform the other.

The views and opinions expressed may https://forexaggregator.com/ at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance.

Comments are closed.